estate tax exemption 2022 proposal

Lower Estate Tax Exemption. The exemption will increase with inflation to approximately 12060000 per person in 2022.

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Transfers exceeding the maximum exemption are currently subject to a 40 tax.

. The GST Exemption Federal law imposes a generation-skipping transfer tax on givers of gifts and bequests to recipients who are two or more generations younger than the givers. Gift Tax Annual Exclusion. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025.

Friday September 17 2021. The top rate would apply to taxable income over. The estate tax exemption reduced by certain lifetime gifts also.

If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax. The publication of this revenue procedure may affect Gould Cooksey clients concerned with the possibility of the imposition of transfer tax liability. In 2026 the exemption is predicted drop to about 6600000 per person.

Absent any further legislation TCJA provisions will sunset at the beginning of 2026. Federal Estate Tax Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. The estate planning world financial planning world and lawmakers considered a number of significant changes to estate and gift taxes the end of 2021 and the Biden Administration set forth a series of proposals to pay for the Build Back Better Act.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. If grandma does no gifting in 2021 and dies in 2022 or thereafter when the exemption would be based upon one half of 11700000 5850000 adjusted for inflation to perhaps 6000000 then. Estate and Gift Tax Exemption.

Proposed Estate Tax Exemption Changes The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. 12 rows The federal estate tax exemption for 2022 is 1206 million.

If enacted the current 117 million per person estate and gift tax exemption would be reduced to 602 million for 2022 based on current estimates. A provision of the proposed legislation that would become effective Jan. The base amount currently is 10000000 set in 2017.

1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for inflation. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. That same estate would result in a taxable estate of about 5700000 per person in 2026 resulting in tax of 2280000.

The tax rate applicable to transfers above the exemption is currently 40. There was discussion of reducing the estate and gift tax exemption from its. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026.

An estate of 11700000 per person 23400000 per couple would result in no tax under current law before 2026. Treasury Department on March 28 2022 released details of tax proposals in the administrations budget recommendations for FY. And finally that same estate would result in a taxable estate of 8200000 resulting in tax of 3690000.

Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. Tax proposals for exempt organizations in Biden Administrations budget for FY 2023. The total value of Doña Ana Countys real and personal property clocked in at 158 billion this year up from 148 billion in 2021.

The tax-free annual exclusion amount has increased to 16000 in 2022. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per. As of January 1 2022 that will be cut in half.

The givers gets a. Proposed tax law changes in the draft legislation that could affect. What is the transfer tax exemption for 2022.

The tax rate on gifts in excess of 12060000 remains at 40. Increase the top rate to 396 beginning in 2023. On Sunday September 12 th the House Ways and Means Committee released a.

The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. The good news is that the once-in-a-lifetime estate and gift tax exemption of 10 million as adjusted for inflation presently 117 million per taxpayer or 234 million for married couples will be intact through the end of. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018.

In addition the proposed bill provides that estates or trusts with income over 100000 would be subject to an additional 3 tax on their modified adjusted gross income. The taxable value of real and personal property is. The Biden administration intends to revert the 117 million exemption to its pre-2010 limit of 35 million 7 million for couples accelerating the TCJA sunset date to early 2022.

The estate tax exemption is. The federal gift tax has yearly exemption of 15000 per recipient per year for 2021 going up to 16000 in 2022. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption.

For 2022 the current amounts for each taxpayer are. Estate Tax Watch 2021. House Ways and Means Committee Proposal Lowers Estate Tax Exemption.

The cumulative lifetime exemption increased to 12060000 in 2022 until after 2025 indexed for inflation. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Estate Tax Definition Federal Estate Tax Taxedu

Biden Administration May Spell Changes To Estate Tax Exemptions And Basis Step Up Rule

New Income Tax Slabs Will You Gain By Switching To New Regime The Economic Times

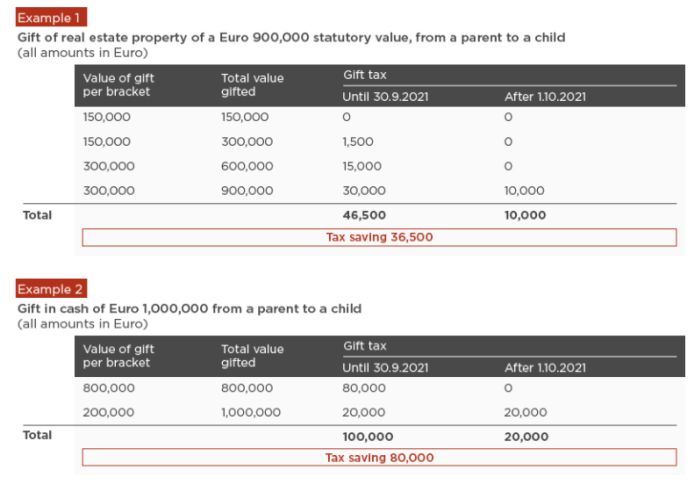

Greece Increases Gift Tax Exempt Bracket From October 1 2021 Tax Greece

Budget 2019 No Your Income Tax Exemption Limit Has Not Been Doubled Businesstoday

Lifetime Qtipable Trusts For Gift Estate Tax Exemption Planning New York Law Journal

Election Special Bulletin 1 Tax Plan Proposal

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

What Happened To The Expected Year End Estate Tax Changes

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

How Do Millionaires And Billionaires Avoid Estate Taxes

Estate Taxes Under Biden Administration May See Changes

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj